In today’s post I’ll walk through what the current economics look like for 3P (logistics) restaurant food delivery in the US and how I see that evolving in the long-term.

If you have any questions or feedback, you can always reach me at annanth.aravinthan@gmail.com or on Twitter at @ProtagorasTO.

To start, I expect long-term EBITDA margins (not adjusted) in the US to settle at around 4-6% of gross bookings. And this process will likely take 4-5 years, with 1-2% improvements each year.

Here is my estimate for what the industry P&L for the US looks like as of Q3 2021, the period during which I wrote most of this post. As a side note, accounting and definitions across platforms differ but are directionally similar. You can find a definition of each line item in the glossary at the bottom of the post.

There’s a few things to call out:

Gross margins as a percentage of revenue are 55% - not terrible but not great either (for reference: eBay 72%, Etsy 73%, Airbnb 79%, and Expedia 80%)

Sales and marketing is 60% of gross profits, this is high for a B2C marketplace and is partially symptomatic of the intense competition that persists in the US (for reference: eBay 33%, Etsy 40%, Airbnb 34%, and Expedia 63%)

The industry is close to EBITDA break-even but is still optimizing for growth

Here is the current base case P&L side by side with how I expect it to evolve over the next 4-5 years:

The rest of the post is a more detailed walk through on some of the assumptions for each line item.

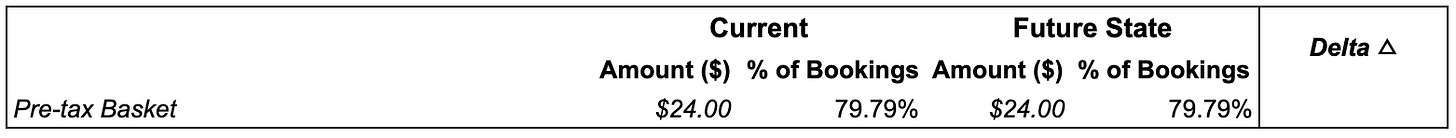

Pre-tax Basket

Increasing basket sizes at scale is hard. Most users have a set budget in mind and the amount of food they’d consume in a single order is fixed. I.e. it’s hard to convince someone ordering just for themselves to add another entree. There are things you can do such as upselling add-ons, algorithmically prioritizing higher basket restaurants, etc. but these only push up basket size marginally. On top of this, basket sizes have gone up significantly during COVID but I suspect at least some of this to reverse over the next one to two years. I expect basket size will stay flat over the next few years.

User Fees

As Amazon demonstrated, users are extremely sensitive to any sort of fee (delivery fee, service fee, etc.). As a rule of thumb for food delivery, a $1.00 increase in fees leads to a 10-15% decrease in order volume (there’s a curve to this). The US industry is hyper competitive, so I expect gross user fees to only increase by $0.25 over the next few years. In addition, fees have already gone up over the past few years to create a stronger value proposition for subscriptions and allow for more targeted promotions and discounts. So it’s in the S&M line where the latter falls and where you’ll see a larger rationalization (more on that below).

Restaurant Commissions

Given the number of restaurants in the US (i.e. DoorDash > 450k), it’s difficult to execute on large scale commission increases without risking significant churn. The largest opportunities are national chains and in new markets where restaurants are incentivized to join the platform through discounted trials.

Given the heightened scrutiny of platforms in the US (i.e. commission caps) and the concentration of chain restaurants, I expect commissions to only increase from 24% to 25% in the medium-term.

Driver Costs

As demand density continues to scale, I expect the number of deliveries per hour per driver to go up and cost per delivery to go down. I also expect 3P native platforms like DoorDash and Uber Eats to continue to improve batching rates through better technology and operations.

That being said, it seems likely that high-income countries (US, UK, Australia, etc.) will pass regulations requiring greater benefits and guarantees for drivers (similar to Prop 22 in California). Some of this will be passed on to end users and some of it will be absorbed by the platforms. I’ve kept driver costs flat but it’s possible this goes up in the future.

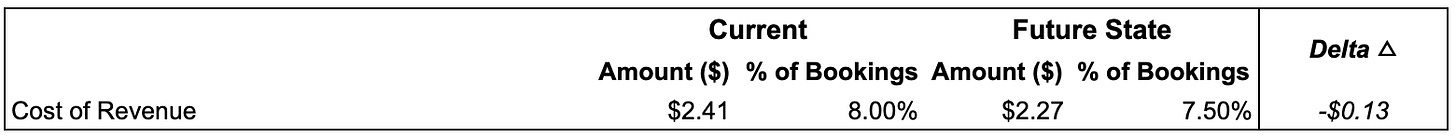

Cost of Revenue

I expect as food delivery platforms continue to scale they’ll be able to marginally bring down their payment processing fees through renegotiations and driver insurance costs.

Sales and Marketing

We can divide sales and marketing spend (which includes promotions and discounts) into two buckets; new and existing users. As the US saturates I expect the former to naturally taper off while the latter is a function of competitive intensity. Over the last few years the market has consolidated and public investors have demanded improvements in cash flows, so everyone has been rationalizing S&M spend. This is typically a gradual process over years as to avoid any sudden losses in market share but you can see an accelerated version with JET in Germany below:

Source: Just Eat Takeaway Capital Markets Day 2021

Increasing “product quality” (speed, selection, reliability, and ease of use) should also improve organic acquisition and retention costs - leading to lower S&M spend.

I do believe that there’s some persistence to competitive intensity - once it embeds itself in an industry’s culture it’s hard to completely reverse. As a result, I think S&M will rationalize over time from 6.00% of GB to 4.00% but likely never reaches the same level as other mature B2C verticals.

Operations and Support

One of the unique challenges of 3P (logistics) food delivery is the operational complexity involved which leads to many defects. The most common are incorrect or missing items in the order and delays vs. the initial ETD. Typically the platform covers the cost of the customer support agent and in some cases the refund or credit (depends on who caused the defect).

Over the past few years these costs have gone down dramatically through better operational processes and technology to both prevent and remediate defects. For example, Uber Eats has developed an AI/ML model that allows customers to receive a refund for missing items through a self-serve channel (if it looks like fraud it’s directed to a human agent).

Less obviously, defects for marketplaces organically go down over time as partners and users move up a learning curve. For example, over time restaurants develop internal processes to ensure all the items in an order are verified before being handed to the driver (that’s partially what the McDonald’s seal sticker is for!).

Research and Develop and General and Administrative

As the core food delivery business matures I expect R&D and G&A costs to largely stay flat while growing revenues create leverage. As a result, I’ve reduced these line items to what I expect their medium term % to be.

Other Profit Pools

In addition to tactical improvements in these line items, there are profit pools within food delivery that I expect to grow faster than the core over the next few years. Specifically, restaurant mix shift towards mom and pops, advertising, subscriptions, and corporate ordering. You can learn more about these in an earlier post here.

Glossary

Pre-tax Basket - the total bill that the customer pays for their food (excludes tips, delivery fee, etc.)

Restaurant Commission - the fees that restaurants pay to be on the platform and access services

User Fees

Delivery Fees - a fixed fee the user pays to the platform

Services Fees - a percentage the user pays based on the basket size

Small Order Fees - a fixed fee the user pays when their basket doesn’t meet a minimum

Driver Pay - the amount paid by the platform to the driver. Note - this is decoupled from the “Delivery Fee”

Cost of Revenue - primarily payment processing fees (~2.5%), chargebacks, cloud and mobile networking fees, and driver insurance

Operations and Support - Primarily consists of partner and user support including outsourced vendors, overhead, labor, and appeasements and credits

Great article! Curious to know your thoughts on how cloud kitchens could potentially impact economics of this space?